Multi-tier clearing guarantee system

1. Participant assessment

The process begins when the application is filed and checks whether the participant meets the own capital criteria. KDPW_CCP regularly assesses participants’ compliance with the capital requirements and prudential standards under the law. more

2. Margins

Margins are used to hedge the risk of clearing transactions of the participant responsible for clearing and are posted individually by clearing members.

Margins are calculated for both cash market transactions and derivatives market transactions/positions.

Types of margins:

- initial margin (including initial margin for loans)

Margin required to hedge market risk in respect of transactions in securities or transactions in derivatives which have not yet been settled. - initial deposit (including initial deposit for loans)

Collateral in acceptable financial instruments which secures changes of intra-day exposure of a member in respect of new transactions, changes of prices, interest rates, exchange rates or risk parameters. The minimum initial deposit is PLN 100,000.

The margins required by KDPW_CCP include the following components:

- SPAN® margin - hedges a loss that could occur in the event of the need to close out the position of a participant defaulting in relation to KDPW_CCP;

- marking-to-market - hedges the change in the present value of the portfolio as a result of market price changes;

- repo rate margin - hedges potential losses in the event of the need to close the portfolio assuming unfavourable changes in the repo rate;

- wrong way risk add-on (WWR) - hedges the risk associated with the clearing member’s and its clients’ exposures in own instruments that are closely correlated with that member’s credit risk;

- concentration and liquidity risk add-on (LCR) - hedges the risk associated with the size of a participant’s position in a given instrument and KDPW_CCP’s ability to close out the position in the market under the conditions of observed liquidity of the instrument and the observed bid/ask price spread.

Information on required margins

Information on the amount of margins required for each account is provided in messages:

- colr.adn.001.01 –add-on calculation parameters

- colr.ins.001.02 - posted or released collateral

- colr.sts.001.03 - posted or released collateral status

- colr.sts.002.01 - client collateral registration status

- colr.sm1.002.03 - collateral register report

- colr.stm.001.02 - statement of credits and debits under the derivatives clearing system and the risk management system

- colr.mrg.001.04 – margin settlement,

- colr.mrs.001.04 – transaction limit status and margin requirement by regulated market or ATS, by clearing member and by account,

- colr.mrl.001.03 – one-off query on margin requirements for all accounts of the clearing member (no need to specify the accounts)

The message structures are available in the tab IT Tools

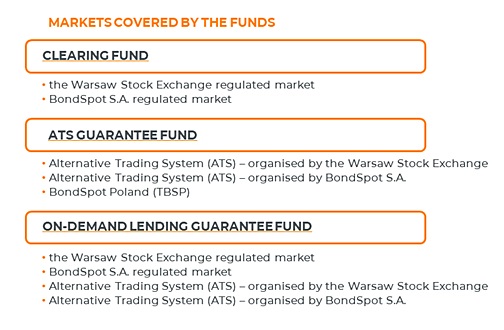

3. Funds (clearing fund/guarantee funds)

Funds’ assets are maintained in order to secure against the risk arising from default of the largest KDPW_CCP clearing member, or second and third largest clearing members, if the total level of their risk exposure is higher. Assets paid into the funds by clearing members are conjointly owned by those members. The funds are used to cover losses arising from the closing of a defaulting member’s positions under extreme market conditions

- the funds are mutual guarantee funds, i.e., clearing members are jointly and severally liable to pay contributions to the funds;

- the clearing fund/relevant guarantee fund covers the risk of default under extreme market conditions of the clearing member with the biggest exposure or the second and third biggest members if their aggregate exposure is greater;

- a clearing member’s exposure is the sum of the uncovered risk determined for all of the member’s portfolios, equal to the difference between hypothetical loss of the portfolio as at the end of day in the clearing system based on extreme parameters and the initial margin required from the clearing member;

- the determined size of the fund may be increased by using a predefined increment ratio

- the fund participants are KDPW_CCP clearing members, i.e., institutions issued a unique LEI code. If an institution active in KDPW_CCP uses more than one unique participant code allocated to a given type of activity in any one fund, the entity which will pay contributions to the fund and, optionally, the institutions which are to receive messages concerning the required contribution amount must be identified: to that end, the clearing member submits a declaration to KDPW_CCP ;

- contributions of clearing members are proportionate to the average exposure of the member in the period under review, subject to a minimum payment;

- the first contributions must be made in cash;

- KDPW_CCP accepts the following as contributions:

- cash (PLN, EUR),

- Treasury securities,

- debt securities in EUR issued by EU Member States other than Poland;

- securities are credited up to 90% of the required contribution amount;

- minimum contributions to the fund:

- PLN 500 000 – Clearing Fund,

- PLN 100 000 - ATS Guarantee Fund,

- PLN 100 000 – On-Demand Lending Guarantee Fund;

- contributions to the funds are determined in PLN;

- the fund resources are updated on a daily basis. The fund participants are notified on every clearing day about the amount of the contribution required at the following day.

4. Own capital of the clearing house amounts PLN 254,34 million (ca. EUR 59,46 million).

KDPW_CCP own capital are maintained in order to cover the insolvency of the two largest exposed clearing members in extreme market conditions:

The resources waterfall is presented in the chart.

KDPW_CCP informs participants of the amount of the dedicated resources and the allocation of such resources in the tab Funds, main resource and allocation.

- dedicated resources I – a dedicated part of KDPW_CCP’s own capital used after the defaulting member’s contributions to the default funds have been used. The amount of the dedicated resources should be at least equal to 25% of the minimum capital,

- dedicated resources II – a dedicated part of KDPW_CCP’s own capital used after the contributions made to the default funds have been used. The amount of the dedicated resources is equal to 25% of the minimum capital,

- the remaining part of KDPW_CCP’s own capital to cover defaults of at least two clearing members with the largest exposures under extreme but plausible market conditions.

The resources waterfall is presented in the chart.

KDPW_CCP informs participants of the amount of the dedicated resources and the allocation of such resources in the tab Funds, main resource and allocation.

5. Remaining resources

Having used all the resources within the system, including own capital assets up to the level of 110% of the minimal required value, KDPW_CCP may call on members to make additional contributions to the funds up to an amount not exceeding 100% of the value of their previous contribution..